Jiangnan Red Arrow: Verification opinion of CITIC Securities Co., Ltd.

2023-06-26 19:07:52

Abstract: CITIC Securities Co., Ltd. issued a verification opinion on the use of bank acceptance bills to pay for raised funds investment projects in Hunan Jiangnan Hongjian Co., Ltd. According to the Measures for the Administration of Major Assets Restructuring of Listed Companies, the Measures for the Administration of Securities Issuance by Listed Companies, and the Listing the company...

CITIC Securities Co., Ltd.'s verification opinion on Hunan Jiangnan Red Arrow Co., Ltd. using bank acceptance bills to pay for funds raised by investment projects

According to the Measures for the Administration of Major Assets Restructuring of Listed Companies, the Measures for the Administration of Securities Issuance of Listed Companies, the Rules for the Implementation of Non-public Issuance of Stocks by Listed Companies, and the Guiding Guidelines for Listed Companies No. 2 – Regulatory Requirements for the Management and Use of Funds Raised by Listed Companies ""Shenzhen Stock Exchange Listing Rules (2012 Revision)", "Shenzhen Stock Exchange Main Board Listed Companies Standard Operation Guidelines", "Hunan Jiangnan Red Arrow Co., Ltd. Management Measures for Raised Funds (Revised in 2013)" Law, regulations and regulations, CITIC Securities Co., Ltd. (hereinafter referred to as “the independent financial adviser (lead underwriter)â€) issued shares as Hunan Jiangnan Hongjian Co., Ltd. (hereinafter referred to as “Jiangnan Red Arrow†or “Listed Companyâ€) An independent financial adviser (lead underwriter) who purchases assets and raises matching funds and related party transactions, and uses the bank acceptance bill to pay for the raised funds investment project of Zhongnan Diamond Co., Ltd. (hereinafter referred to as “Zhongnan Diamondâ€), a wholly-owned subsidiary of Jiangnan Hongjian ( The following is referred to as the “raised investment projectâ€. The financial matters have been verified, and the verification situation is as follows. :

I. The situation of raising funds for this restructuring

Jiangnan Red Arrow is not publicly approved by the China Securities Regulatory Commission on the approval of Hunan Jiangnan Red Arrow Co., Ltd. to issue shares to China Ordnance Industry Group Co., Ltd. to purchase assets and raise matching funds (Zheng Jian Li [2013] No. 1012) 136,715,909 shares of RMB ordinary shares (A shares) were issued, and the issue price was RMB 9.68 per share. The total amount of funds raised was RMB 1,323,409,999.12. After deducting the issuance expenses, the net proceeds were RMB 1,269,988,011.39. The above-mentioned raised funds have been verified by Dahua Certified Public Accountants Co., Ltd. (Special General Partnership) and issued the “Capital Verification Report on the paid-up capital of the RMB 167,759,909 shares issued by Hunan Jiangnan Hongjian Co., Ltd.†(Da Huazhen) Word [2013] 000339). After the above-mentioned net proceeds are in place, all of them will enter the special fundraising account opened by the listed company for storage and management.

In view of the fact that Jiangnan Hongjian’s reorganization of the fund-raising project is the implementation of Jiangnan Hongjian’s wholly-owned subsidiary, Zhongnan Diamond and Zhongnan Diamond’s subsidiary, Jiangxi Shentian Carbon Co., Ltd., which was reviewed by the listed company’s third extraordinary shareholders meeting in 2013. Through the listing, the listed company increased the capital of Zhongnan Diamond by RMB 1,269,988,011 with the matching funds raised in this restructuring. Zhongnan Diamonds completed the registration procedures for industrial and commercial changes on January 15, 2014, and obtained the Business License for Enterprise Legal Persons issued by the Fangcheng County Administration for Industry and Commerce. The registered capital and paid-up capital of Zhongnan Diamonds was RMB 450,000,000. The RMB was changed to RMB 1,719,988,011. After the completion of the capital increase, the matching funds raised in this restructuring have all entered the listed company's fundraising account opened in the name of Zhongnan Diamond for storage and management.

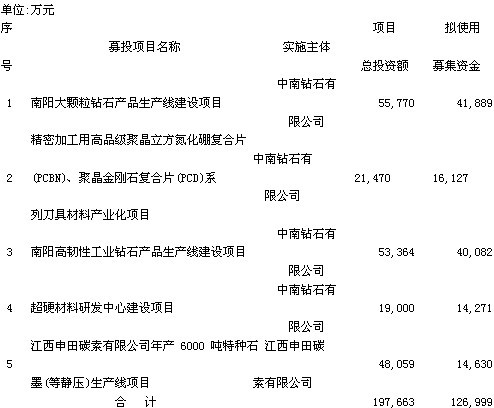

Second, the fundraising project overview

According to the relevant resolutions of the first extraordinary shareholders meeting of the listed company in 2013 and the final actual issuance, the fundraising project and the use plan for the non-public offering of shares of the matching fund are as follows:

3. Regarding the use of bank acceptance bills by Zhongnan Diamonds to pay for funds for investment projects

Zhongnan Diamond collects a part of bank acceptance bills in the daily operation process, some of which are used for external payment. The other part of the bank acceptance bills need to be discounted by bank, and the maturity can be converted into bank deposits to cover the cost of daily operations. , the cost, increased the company's financial expenses. In order to improve the efficiency of capital use and reduce the cost of capital use, Zhongnan Diamond intends to use the bank acceptance bills received during the production and operation activities to pay the funds payable for the project, equipment purchases, etc. during the implementation of the fundraising project. Transfer the equal amount of funds from the fundraising account as the working capital for daily operations. On January 16, 2014, the 20th meeting of the 8th Board of Directors of the listed company and the 18th meeting of the 8th Board of Supervisors reviewed and approved the investment project on the use of bank acceptance bills to pay for raised funds by the wholly-owned subsidiary Zhongnan Diamond Co., Ltd. The Proposal on Funds agrees that Zhongnan Diamonds will use the bank acceptance bill to pay part of the fundraising project funds. Li Zhihong, Li Xiaolong and Zheng Jinqiao, independent directors of listed companies, issued their opinions agreeing to implement the use of bank acceptance bills to pay for fundraising projects.

In order to strengthen the management of the use of raised funds and ensure that bank acceptance bills are used for fundraising projects, the Zhongnan Diamond Package has developed relevant operational procedures, as follows:

1. The main body of the fundraising project construction, material procurement, asset management and other relevant departments shall, according to the needs of the construction of the fundraising project, confirm the payment that can be made by the bank acceptance bill before signing the procurement, construction or related contract with the relevant supplier of the fundraising project. .

2. When paying the bank acceptance bill payment, the relevant departments of fundraising project construction, material procurement, asset management and other relevant departments fill in the payment application form, and indicate that the payment method is a bank acceptance bill, and the Zhongnan Diamond Finance Department applies the payment request after approval. For the payment of bank acceptance bills, the Zhongnan Diamond Finance Department shall attach a copy of the acceptance bill to each payment and mark the ticket number on the payment application form.

3. The Central and South Diamond Department of Finance prepares a summary of the payment of bank acceptance bills on a monthly basis, and reports to the chairman of the board at the end of each month and informs the independent financial adviser. If the accumulated amount in the current month reaches RMB 50 million and the end of the month is not reached, the Zhongnan Diamond Finance Department shall immediately perform the approval process and notify the independent financial consultant. After approval and independent financial adviser has no objection, the Zhongnan Diamond Finance Department will supervise the raised funds account. The bank shall submit the application for the written replacement of the raised funds of the bank acceptance bills used for the raised funds; after the approval of the bank approved by the fundraising account, the funds used for the construction of the fundraising project paid by the bank acceptance bill shall be the same amount from the fundraising account. Transfer to the Central South Diamond General Account.

IV. Independent financial adviser (lead underwriter) verification opinion

Through interviews with the directors, supervisors, senior management personnel and other personnel of the listed company, the relevant information disclosure documents of the fundraising projects in the process of purchasing assets and raising matching funds will be consulted, and the board of directors and the board of supervisors of the listed company will pay for the use of bank acceptance bills. The resolution document of the funds for the investment project, the independent director's consent on the use of the bank acceptance bill to pay the funds for the investment project, and the independent financial adviser (the lead underwriter) to pay the funds for the investment project using the bank acceptance bill. The rationality and necessity of the verification were carried out.

Upon verification, the independent financial adviser (lead underwriter) believes that the use of bank acceptance bills to pay for fundraising project funds has been reviewed and approved by the board of directors and the board of supervisors of the listed company, and all independent directors have expressed their consent and fulfilled the necessary internal decision-making procedures. , in line with the “Regulations for the Supervision of Listed Companies No. 2 – Regulatory Requirements for the Management and Use of Funds Raised by Listed Companiesâ€, “Stock Listing Rules of Shenzhen Stock Exchange (Revised in 2012)â€, and Guidelines for Standard Operation of Listed Companies on the Main Board of Shenzhen Stock Exchange 》, “Hunan Jiangnan Red Arrow Co., Ltd. Management Measures for Raised Funds (revised in 2013) and other relevant regulations. The use of bank acceptance bills to pay for fundraising project funds does not affect the normal conduct of fundraising projects. There is no disguised change in the funds raised and the interests of shareholders.

Therefore, the independent financial adviser (lead underwriter) agreed that Zhongnan Diamond, a wholly-owned subsidiary of the listed company, should implement the bank acceptance bill to pay the funds for the investment project.

Financial Advisor Sponsor: Zhao Jinyu

CITIC Securities Co., Ltd.

January 17, 2014

January 17, 2014

stainless steel sink strainer can be used for fruit and vegetable washing drain basket, it is a useful stainless steel kitchen tool and it also called Draining Rack or draining basket. It is very useful when you wash your fruit and vegetable, it will make your fruit and vegetable health to eat.

The material is food grade 304 stainless steel which is anti rust and easy to wash

Fruit Vegetable Washing Draining Basket,Stainless Steel Kitchen Tool,Draining Rack, Draining Basket

Shenzhen Lanejoy Technology Co.,LTD , https://www.grill-grid.com