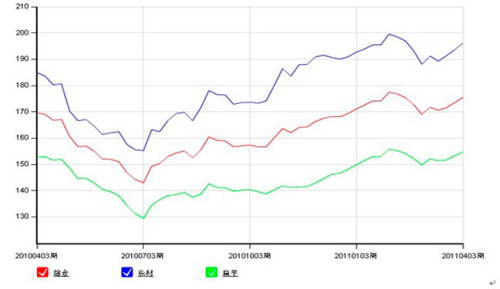

April 15 Steel Price Index

On April 15, the National Bureau of Statistics announced the economic operating data for the first quarter, of which GDP in the first quarter was 963.11 billion yuan, a year-on-year increase of 9.7% at comparable prices; CPI rose 5.4%, fixed-asset investment grew by 25.0%, real estate investment The year-on-year increase was 34.1%. In addition, the Bureau of Statistics also announced the output of crude steel in March. The data show that domestic crude steel output in March was 59.42 million tons, an increase of 9.0% over the same period of last year. The average daily output was 1,916,800 tons, a decrease of 22,800 tons. From January to March, domestic crude steel output was 169.91 million tons, an increase of 8.7% over the same period of last year.

Myspic Composite Index this week was 175.5 points, up 1.2% from the previous week. This week, the domestic steel market has been slowly increasing. Initially driven by the long-term prices, the market transactions have picked up more remarkably. Businesses have pulled up their desires and they have been stimulated. The price increase has also been relatively large. However, with the continuous and rapid rise in market prices, the market demand in the end of this week will gradually increase the terminal wait-and-see atmosphere, there has been a trend of weak and volatile forward prices, causing the business mentality once again turned cautious, quotes stabilized, wait and see the market. The current market cost support is still relatively large. In some areas, market inventories have also decreased significantly, giving the bottom prices a relatively large amount of support. Therefore, there is little room for market correction. However, given the contraction of transactions, the power for continued upward growth is also insufficient.

This week, the flat product index was 154.7 points, up 0.9% from last week. Among them, the medium-thickness index and hot-rolled index rose relatively large, rising by 1.4% and 1.1% respectively. In the plate market, the Xi'an market and the Chongqing market have seen relatively large increases. This week, the plate market in Xi’an grew steadily. Initially, it was driven by the overall national plate market. Xi’an market players also followed suit, and local market resources were relatively scarce, making the low price increase more significant. After the increase in quotation, the Xi'an plate market performed more steadily. The shortage of resources made the merchants always have a mentality of pulling up, and the attitude of reluctant sellers appeared, and the price continued to rise slightly. The Chongqing plate market continued to soar this week. With the recent rise in prices, market transactions have picked up. At the same time, social inventories have shown a slight downward trend, and the shortage of certain specifications has become more and more intense. Therefore, the transaction prices of individual resource markets have increased significantly. In the later period, due to a wait-and-see situation in demand, the market performance became stable, and merchants were not in a hurry to ship. The mentality was relatively calm. This week, the 20mm plate thickness of Xi'an Market and Chongqing Market rose by RMB 90/ton and RMB 100/ton respectively.

In the hot rolling market, the Shanghai market and the Xi'an market have seen relatively large gains. Shanghai's hot-rolling market oscillated this week. Shanghai's hot-rolling market performed well this week, driving the continuous rise in market prices. However, businesses are not particularly optimistic about the current rally, that the current round of rising is mainly driven by the long-term prices, the lack of support for the remaining increase, subject to this state of mind, businesses are not reluctant to sell limited sales, shipping ** attitude is more obvious. With the increase in prices, the market is still showing signs of a wait-and-see attitude both in the market and in demand. The hot market in Xi'an this week was driven by the continuous rise of the surrounding markets and raw materials market, and the local market steadily increased. This week, local steelmakers still increased the ex-factory price, and the cost support gave the market a large upward power. However, the current market transactions mainly come from the intermediate demand, and the terminal demand has not increased significantly. Therefore, the business mentality is still cautious and follows domestic mainstream adjustments. price. This week, the 3.0mm hot rolled Shanghai market and Xi’an market were up 80 yuan/ton and 90 yuan/ton respectively from last week.

The long products index was 196.2 points this week, up 1.3% from last week. This week, domestic steel prices fluctuate, and rise and fall, making spot market prices rise and stabilize. Which Guangzhou market and Shenyang market rose relatively large. The long products market in Guangzhou last weekend traded better, so this week opened the market, businesses continue to pull up prices, some businesses reluctant to sell limited sales, the market appears to be more confusing. In the later period, the oscillating price movements in the market caused certain changes in the business mentality and no longer continued to increase. However, as the local steel mills continue to increase the factory prices, the bottom support of the market is relatively large, making the market price not to have a correction, but it is holding at a high level. Shenyang's long products market rose steadily this week. Affected by the rapid pull-up in the external market, the Shenyang market has also seen a relatively significant increase. In the case of rising billet prices, steel mills have also continuously raised the ex-factory prices. At the beginning of this week, the Shenyang market was in good condition. However, after consecutive pull-ups on Monday and Tuesday, market demand began to soften, and merchants no longer raised the quotation, but also shipped the goods. The intention was stronger. This week, the HRB335 20mm thread in the Guangzhou market and Shenyang market rose by 90 yuan/ton and 80 yuan/ton respectively from last week.

In terms of regions, there was a large increase in the local market. However, due to the stronger control of inflation expectations in the later period, the demand terminal has not fully recovered to normal levels, so the market's sustained upward momentum is not sufficient. Fortunately, the current market resource cost support is large, and the callback space is very limited. Businesses also need to maintain a cautious attitude, not blindly optimistic, reluctant to sell, it may be more important to see it.

Aluminum Rails,Aluminum Clamps,Tile Roof Hook

Solar Roof Mount Jade Motor Co., Ltd. , http://www.nsgroundscrew.com